Raising money for your startup and stuck choosing between a convertible note vs. SAFE? You’re not alone. These two instruments dominate early-stage startup financing, and while they seem similar at first glance, the differences can significantly affect your cap table, legal exposure, and investor relationships.

In this post, we’ll break down what convertible notes and SAFEs are, how they work, their pros and cons, and which one might be the better fit depending on your startup’s stage and goals.

What is a Convertible Note?

A convertible note is essentially a short-term loan that turns into equity in the future—typically when your startup raises a priced round of funding. Investors give you cash now, and instead of paying them back, their note “converts” into shares when your company raises a Series A (or another qualifying round).

Key Features of Convertible Notes:

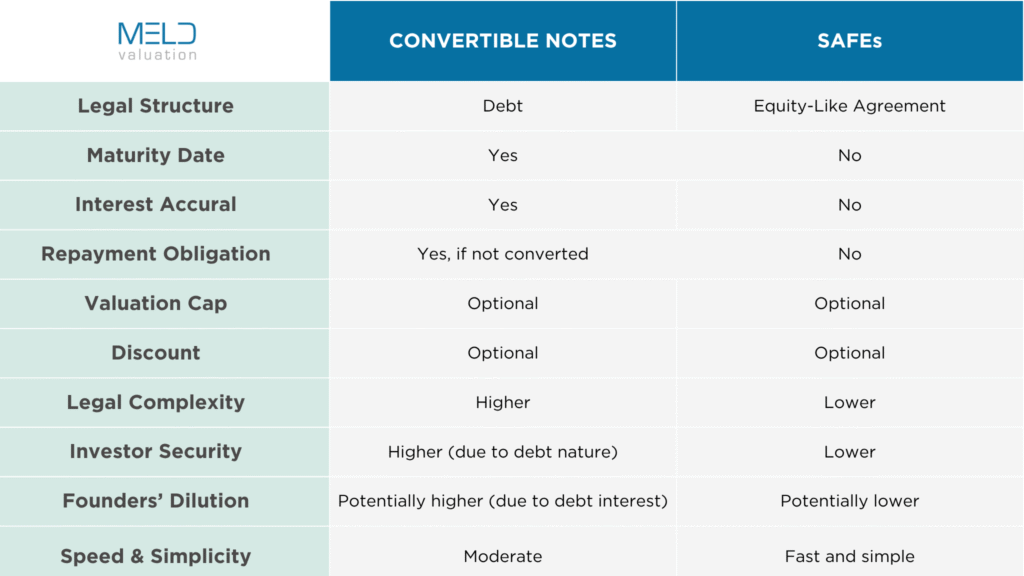

- Structured as debt

- Includes interest rate

- Has a maturity date (when the note must be repaid or converted)

- Often includes a valuation cap and/or a discount on the next round

Pros of Convertible Notes:

- Widely understood and accepted by investors

- Provides flexibility when you don’t want to set a valuation too early

- The maturity date creates urgency to close the next round

Cons of Convertible Notes:

- Legal complexity due to its debt nature

- Accrues interest over time, adding to dilution later

- If no future round occurs, you may owe repayment at maturity

What is a SAFE Agreement?

SAFEs—Simple Agreements for Future Equity—were created by Y Combinator as a more startup-friendly alternative to convertible notes. They’re not debt, don’t accrue interest, and don’t have a maturity date. Instead, they convert to equity during a future priced funding round.

Key Features of SAFEs:

- Not structured as debt (no interest, no repayment)

- No maturity date or deadlines

- Usually include a valuation cap, a discount, or both

- Simpler legal document (typically 5 pages or less)

Pros of SAFEs:

- Lower legal costs and quicker to draft

- No ticking time bomb of maturity

- Reduces complexity in early-stage funding rounds

Cons of SAFEs:

- No repayment mechanism—investors bear more risk

- No timeline means lack of urgency to raise a priced round

- Can cause cap table confusion if multiple SAFEs are issued with different terms

Convertible Notes vs. SAFEs: A Side-by-Side Comparison

When to Use a Convertible Note

Convertible notes are generally a better fit when:

- You’re raising from traditional investors or angels who expect some legal structure and downside protection

- You anticipate raising a priced round soon and want to incentivize quick investment

- You’re okay with the possibility of eventual repayment if things don’t go as planned

When to Use a SAFE

SAFEs are ideal if:

- You’re in the very early stages and want to keep legal costs minimal

- You’re raising small amounts from friendly investors, like accelerators or early supporters

- You want a simple agreement with fewer long-term obligations

What Investors Think of Convertible Notes vs. SAFEs

Investor sentiment can vary widely:

- Institutional Investors: Many VCs prefer convertible notes because of the added protections like interest and maturity. Some will agree to SAFEs, but may push for more favorable terms.

- Angel Investors: Some angels like SAFEs for their simplicity, while others prefer notes because they feel safer.

- Accelerators: Programs like Y Combinator almost exclusively use SAFEs for their speed and founder-friendliness.

Ultimately, it comes down to negotiation. Some investors are happy with a SAFE if the cap is attractive. Others won’t budge without a note and a hard maturity date.

Convertible Note vs. SAFEs: Legal and Tax Implications

Convertible Notes: Since they’re debt, there’s a risk that if your company folds, the investor could be seen as a creditor. That could have tax and legal consequences for your startup.

SAFEs: Because they aren’t debt, SAFEs don’t appear as liabilities on your balance sheet. However, since they’re not equity either, some accounting teams get confused on how to record them. Also, they don’t offer tax advantages like QSBS (Qualified Small Business Stock) unless converted into actual equity.

If you’re serious about raising funds, talk to your legal counsel and tax advisor before choosing either instrument. These decisions can snowball later in big ways.

Final Thoughts

So, which one should you go with—Convertible Note or SAFE?

It really depends on your startup’s needs, your timeline, your risk tolerance, and the preferences of your investors. Here’s a quick way to think about it:

- Go with a SAFE if you’re just getting started, raising from friends or angel investors, and want something quick and clean.

- Lean toward a Convertible Note if your investors want more protection or if you’re raising a large round and expect to follow up with priced equity in the near future.

No matter which route you choose, get clear on your terms and make sure everyone understands the implications. Founders often focus so much on getting the money that they overlook how those early deals shape the company’s long-term ownership and control.

Convertible Notes vs. SAFEs FAQs

Do SAFEs dilute founders?

Yes, when they convert to equity, SAFEs dilute the founders just like any other investor round.

Can convertible notes or SAFEs convert without a priced round?

Some convertible notes can convert at maturity or under specific terms. SAFEs typically require a priced round unless there’s a specific trigger in the agreement.

Are convertible notes or SAFES more common in 2025?

SAFEs are more popular for pre-seed and seed rounds, especially in startup hubs like Silicon Valley. Convertible notes are still used frequently, especially outside the accelerator ecosystem.

What happens if a SAFE never converts?

That’s a risk. Since it’s not debt, there’s no repayment. If no priced round ever happens, the SAFE holders could end up with nothing.

Are SAFEs legally enforceable?

Yes, but they offer fewer protections than convertible notes, so disputes can be more ambiguous.

Looking Ahead

Startup fundraising is evolving fast. Convertible notes and SAFEs are just tools—you don’t need to swear loyalty to one over the other. The real key is understanding your business, your growth path, and the preferences of the people writing the checks.

And hey, whichever one you pick—make sure you read the fine print.

Let’s talk

Schedule an intro call to learn about why MeldVal is important for your business. Or have any questions? We’re here to help.

Contact us