Compliance, Start Ups, Stock Options

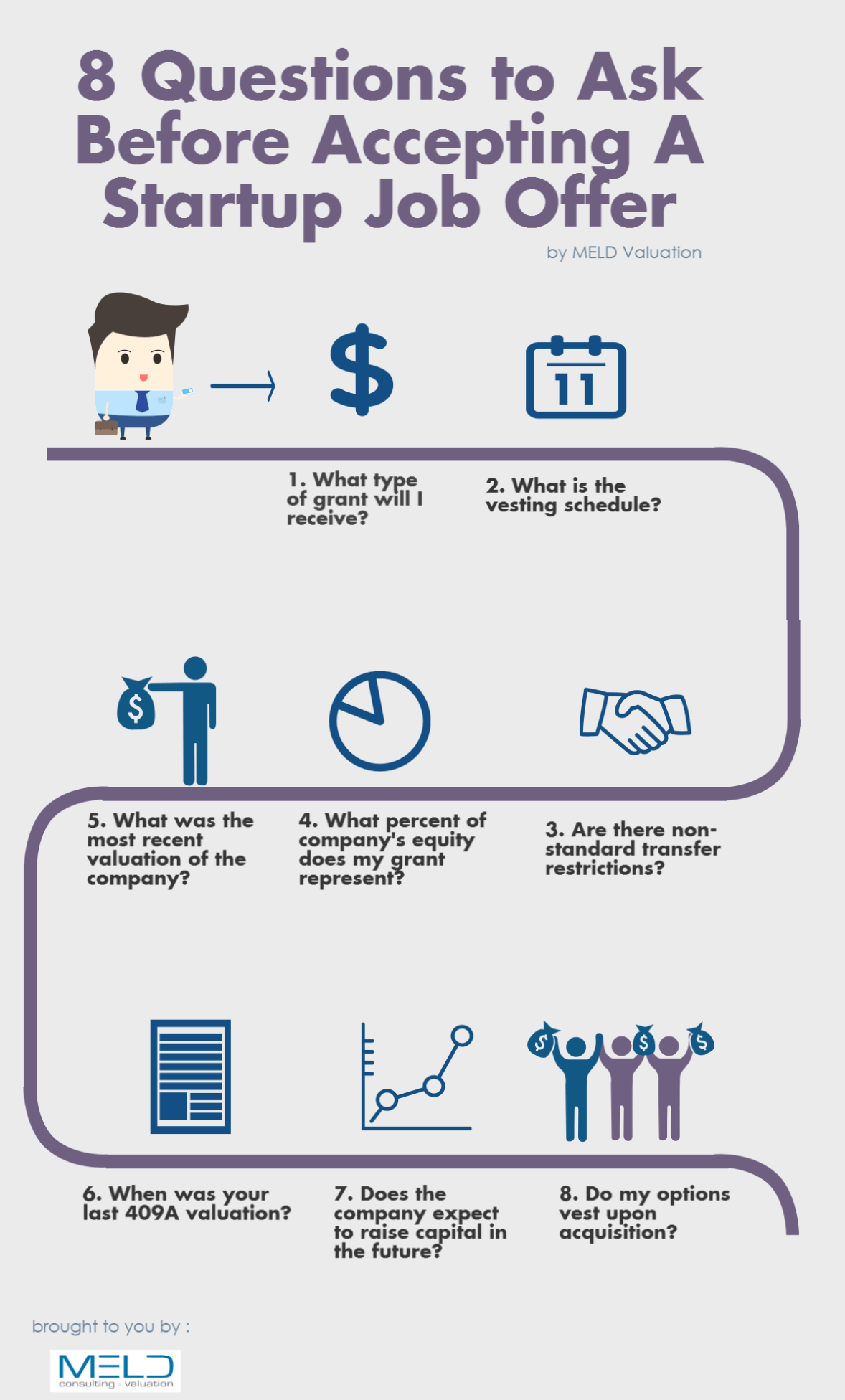

8 Questions to Ask Before Accepting a Job at a Startup

By Dan Eyman

September 22, 2015

1. What type of equity grant will I receive?

Equity can be granted in the form of Incentive Stock Options (ISO), which is most typical for and can only be granted to employees, Nonqualified Stock Options (NSO), and Restricted Stock Units (RSU). For the difference on ISO versus NSO see @Capshare’s blog post here. There are nuances in the tax treatment of these different type of grants so ask and check how it will affect you.

2. What is the vesting schedule?

If RSU: Is there a performance condition tied to these RSUs?

Typically equity vests over time in an attempt to align the company and employee incentives. Standard vesting schedules typically are set over four years with 25% vesting after one year the rest vesting monthly over the next three years.

Restricted Stock Unit (RSU) grants sometimes have a performance condition tied to them, which means they may not vest until the company realizes an exit event such as an IPO or acquisition.

3. Are there non-standard transfer restrictions (such as requiring board approval)?

Once the equity vests, it remains yours, but there are some limitations on what you can do with it. Having transfer restrictions on your shares is common, so watch out for non-standard ones.

4. What percentage of the company’s equity do the options represent?

The number of shares granted really don’t matter if you don’t know the denominator, i.e. the total number of shares. Don’t think in terms of number of shares or the valuation of shares when you join an early-stage startup. Think in terms of percentage of the fully diluted shares outstanding (FDSO).

Many early stage startups ignore Convertible Notes when they give you the Fully Diluted Capital number to calculate your ownership percentage. Convertible Notes are typically issued to angel or seed investors before a full VC financing. The company converts the Convertible Notes into preferred stock during a VC financing at a discount from the price per share paid by VCs.

Since the Convertible Notes are a promise to issue stock, you’ll want to ask the company to include some estimate for conversion of Convertible Notes in the Fully Diluted Capital to help you more accurately estimate your Percentage Ownership.

5. What was the most recent valuation of the company?

This can potentially help you understand the value of your grant but a lot of startups will not be willing to share this with you. Does not hurt to ask though.

6. What was the most recent “409A” valuation and when was that valuation done?

The 409A valuation is an appraisal done for tax purposes and done annually or upon a new round of financing. The exercise price of options is set by the 409A valuation. You should ask when the last 409A valuation was done. If it’s been a while, the company may have to do another 409A valuation, which means your exercise price may go up.

7. Does the company expect to issue stock or raise a new round in the foreseeable future?

This will give you some insight into whether there are any dilutive events on the horizon. Another way to back into this is to ask about the companies current cash runway.This should give you an idea how long the company can continue to operate before needing additional capital. New capital typically has a dilutive effect.

8. Does my vesting accelerate if the company is acquired?

It is not uncommon for companies to offer accelerated vesting upon the company’s acquisition. Accelerated vesting is nice to have in an exit event. The acquiring company may lay you off or you may not want to work for the acquirer.

Let’s talk

Schedule an intro call to learn about why MeldVal is important for your business. Or have any questions? We’re here to help.

Contact us