Fund Strategy & Structuring

Convertible Notes Valuation Caps & Discounts: How Do They Work?

By Dan Eyman

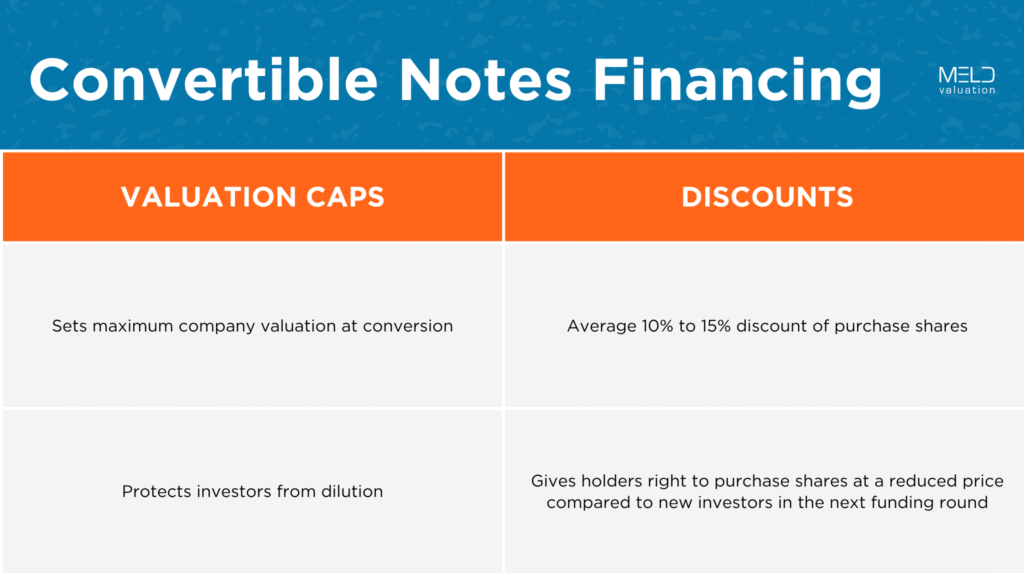

Convertible notes valuation caps and discounts are designed to make fundraising easier, but the details can get fuzzy. These two terms play a huge role in determining how much equity early investors receive when their notes convert.

If you’re a founder or an investor, understanding how these mechanics work is essential to protect your interests and keep your cap table clean. Here’s the breakdown.

How Do Convertible Note Valuation Caps and Discounts Work?

Convertible notes are a startup financing favorite for a reason—they’re fast, flexible, and delay the tough conversations around valuation. But eventually, those notes convert to equity, and when they do, discounts and valuation caps determine just how sweet the deal is for early investors.

So let’s dig into what these terms mean, how they work in practice, and what they mean for both sides of the deal.

What is a Discount?

A discount gives convertible note holders the right to purchase shares at a reduced price compared to new investors in the next funding round.

Example of Convertible Notes Discounts

Let’s say you raise a $2M seed round at a $10M valuation, and your early note investors have a 20% discount. Instead of buying shares at the $10M valuation, their conversion price is based on an $8M valuation. They get more shares for the same investment—essentially a reward for getting in early.

Founder Tip: Discounts are generally in the 10–25% range. The higher the risk in your early round, the steeper the discount investors will expect.

What is a Valuation Cap?

A valuation cap sets the maximum company valuation at which the note will convert, regardless of the valuation you raise at. It protects investors from getting diluted if your startup suddenly becomes the next unicorn and raises a priced round at a much higher valuation.

Example of Convertible Notes Valuation Caps

Your investor has a note with a $5M valuation cap. If your Series A happens at a $15M pre-money valuation, that investor’s note will convert as if the valuation were only $5M.

Translation: They get a significantly larger chunk of equity than they would without the cap.

So, What Happens When You Have Both?

Most convertible notes include both a discount and a valuation cap. In that case, the note typically converts at whichever method gives the investor more shares—the lower price per share.

Quick Scenario:

- Series A Valuation: $12M

- Investor has a 20% discount and a $6M valuation cap

Let’s break it down:

- Discounted price = $12M * (1 – 0.20) = $9.6M

- Cap price = $6M

The note will convert using the $6M valuation cap, because it results in a lower share price and more equity for the investor.

Impacts of Convertible Notes Valuation Caps and Discounts on Founders and Investors

Impact on Founders

From the founder’s perspective, discounts and caps are a trade-off:

- Pro: You delay valuation discussions and raise money faster.

- Con: You risk greater dilution later, especially if your company grows fast between rounds.

Best Founder Practices

- Run the math early so you know what your cap table will look like post-conversion.

- Keep discount and cap terms consistent across notes to avoid confusion or unfairness.

- If you’re using both, understand that the cap will usually drive conversion.

Impact on Investors

For investors, discounts and caps are all about risk compensation:

- The earlier they invest, the more uncertainty they take on.

- In return, they want better terms if things go well.

A lower cap = better upside.

Best Investor Practices

- High caps or small discounts that offer little reward

- Notes without caps (in later rounds, this can be a red flag)

- Clear documentation of how the conversion mechanics are calculated

Find a Funding Structure That Works

Understanding how discounts and valuation caps work isn’t just about protecting yourself—it’s about keeping your funding journey smooth and fair for everyone involved.

If you’re unsure how these terms will affect your equity or your investors’ returns, don’t guess. Modeling out the conversion ahead of time (or getting a pro to help) can save you serious headaches later on.

Want help modeling how your notes will convert or figuring out fair cap and discount terms?

Get in touch—we’d be happy to help you walk through the numbers and find a structure that works.

Let’s talk

Schedule an intro call to learn about why MeldVal is important for your business. Or have any questions? We’re here to help.

Contact us