Today we are going to write a brief and basic intro into how venture capital funds are structured, who there investors are, how they typically work.

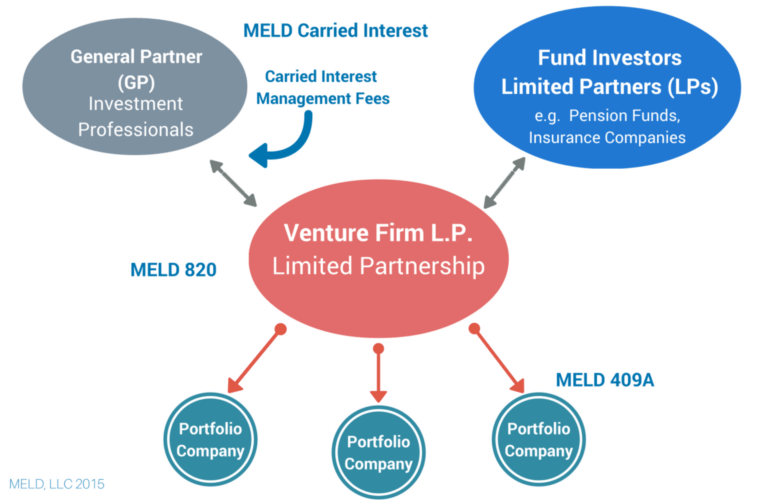

Limited Partnerships: Most venture capital funds are limited partnerships typically with twp types of partners. The general partner and the limited partner.

Limited Partner: Typically these are pension funds, (think CalPERS, CalSTRS) insurance companies, university endowments, family offices and a whole bunch of other entities that have a lot of money. To the best of my knowledge limited partners can be a legal entity while a general partner needs to be a human being ( if you really care about this point then consult an attorney)

General Partner: These are the “VC”s and are involved with several several roles simultaneously. General partners pursue investment opportunities and manage the investments of the funds. The GPs have a fiduciary duty to the LPs to manage the investments. Generally, the obligations of general partners to the venture capital fund are governed by the partnership agreement. These obligations include the duties of loyalty, care, and good faith and fair dealing.

Capital Commitments: Limited Partners do not actually invest money in the Fund at the closing. They legally commit to provide a certain amount of capital when they are called upon. This is called a Limited Partner’s Capital Commitment. Which leads to capital calls…

Capital Calls: When the General Partners or the “VC” finds the next unicorn that they are going to invest in they make a “capital call” on the Limited Partners.

Portfolio Company: These are the startups that the fund invests into. MELD Valuation offers 409A valuations for portfolio companies and portfolio valuation services to investors(820).

How Everyone Makes Money: VC make money on what is called the carry and run the fund with management fees. General partners charge a management fee on total capital committed to the fund. A typical fee is around 2.0%. So if the fund is a total of $500M then the fee is $10.0M per year. These fees pay the salaries, rents, travel. support services, etc…

Ok….so the GPs have invested in nothing but unicorns and have gotten spectacular exits. Time to divvy up the sweet returns. Returns from investment are split between the LP and the GP. VCs also have a performance-based element of their compensation, called “carry,” which often equates to around 20 percent of the profit from their investments. In order for the carry to kick in, the fund and all management fees must first be returned. MELD offers carried interest valuations for transfer purposes.

Let’s talk

Schedule an intro call to learn about why MeldVal is important for your business. Or have any questions? We’re here to help.

Contact us