If you’re a CFO managing Level 3 assets, understanding ASC 820 is table stakes.

It governs how investments are valued and disclosed—and determines whether your audit wraps up smoothly or gets stuck in memo rewrites and rework.

Here’s what every finance leader needs to know to stay compliant and confident.

What ASC 820 Means in Plain English

ASC 820 defines how to measure and report fair value in financial statements.

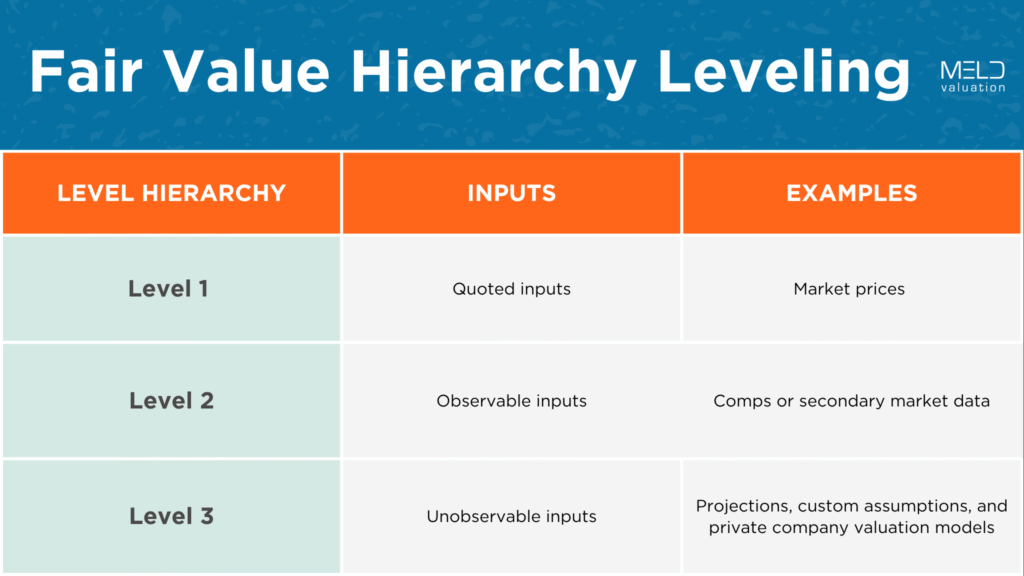

It establishes a hierarchy of inputs:

- Level 1: Quoted market prices (easy)

- Level 2: Observable inputs (like comps or secondary market data)

- Level 3: Unobservable inputs (like projections, custom assumptions, and private company valuation models)

Most private investments fall under Level 3—which means more scrutiny, more assumptions, and more documentation.

Understanding the Levels: Why They Matter

The higher you go on the hierarchy (Level 1 = best), the less documentation you need.

Level 3 requires:

- Careful calibration to market data

- Supportable inputs and discount rates

- Detailed valuation memos

ASC 820 compliance isn’t about perfection. It’s about transparency and defensibility.

Documentation and Audit Readiness

Your auditors expect:

- A current valuation memo for every material investment

- Clear rationale for each input used

- Footnote disclosures tied to valuation hierarchy levels

- Evidence of internal review or oversight

This is especially critical in year-end audits or when LPs ask for detailed NAV support.

Avoiding ASC 820 Compliance Gaps

- Don’t wait until the audit to start building your valuation support

- Regularly review and update your memos as market conditions shift

- Use independent business valuation experts when internal data is limited or complex instruments are involved

Get a Pre-Audit ASC 820 Valuation Review

ASC 820 isn’t just a disclosure requirement. It’s what investors, auditors, and regulators use to determine the credibility of your valuations.

Don’t wait for your audit to flag potential issues.

Let’s talk

Schedule an intro call to learn about why MeldVal is important for your business. Or have any questions? We’re here to help.

Contact us