Compliance

QSBS Requirements: 5 Eligibility Criteria for Tax Exemptions Every Founder Should Know in 2026

By Dan Eyman

Qualified Small Business Stock (QSBS) is one of the most generous tax breaks available to startup founders, early employees, and investors—but it doesn’t apply automatically.

To claim up to $15 million in tax-free capital gains, your stock must meet a specific checklist of requirements under Section 1202 of the Internal Revenue Code.

Here are the five most important QSBS requirements that determine whether your shares can unlock this powerful tax benefit.

5 QSBS Requirements Founders Should Know to Determine if You’re Eligible for Tax Exemption

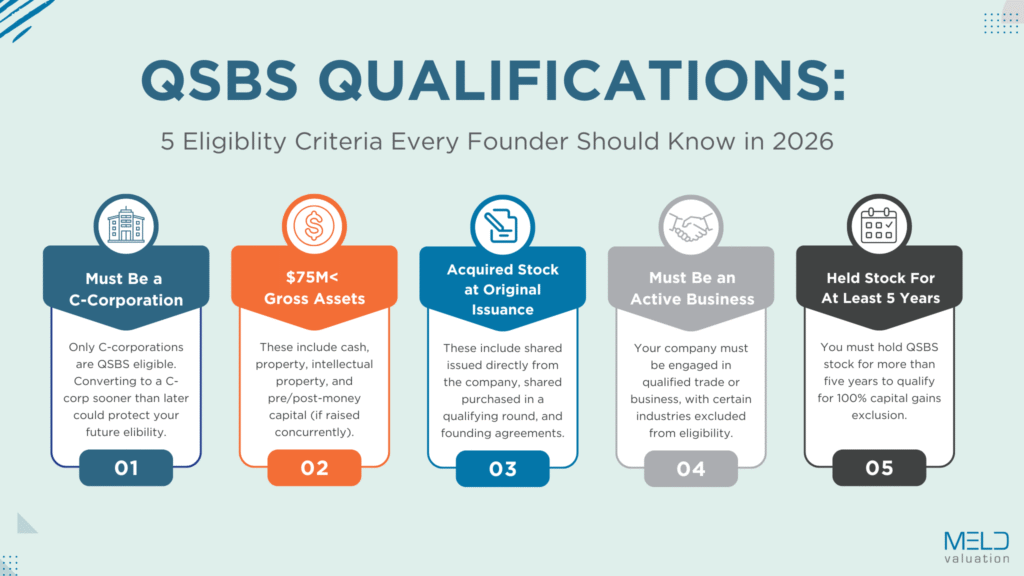

1. Your Company Must Be a U.S. C-Corporation

Only C-corporations are QSBS eligible. If your company is structured as an LLC or S-corp at the time your shares are issued, the clock doesn’t start—and your shares won’t qualify.

If you’re operating as an LLC but plan to raise institutional capital, converting to a C-corp sooner rather than later could protect your future eligibility.

2. Gross Assets Must Be Under $75 Million

According to QSBS rules, the company must have $75 million or less in aggregate gross assets at the time the stock is issued.

This includes:

- Cash

- Property

- Intellectual property

- Pre-money and post-money capital (if raised concurrently)

If your company exceeds the $75 million threshold before your stock is issued, those shares will not meet QSBS qualifications.

3. You Must Acquire the Stock at Original Issuance

What qualifies:

- Shares issued directly by the company

- Stock granted as part of a founding agreement or option exercise

- Shares purchased in a qualifying round (as an individual or trust)

What doesn’t qualify:

- Secondary purchases from other shareholders

- Transfers on the open market

- Warrants or SAFEs that have not converted to stock

QSBS status is only triggered when you receive the shares directly from the company—not from someone else.

4. Your Company Must Be an Active Business

Passive businesses don’t count. To be QSBS eligible, the company must be actively engaged in a qualified trade or business.

Excluded businesses include:

- Financial services

- Real estate investing

- Professional services (e.g. law, consulting, accounting)

- Hospitality, farming, or resource extraction

Included businesses:

- Tech startups

- Product-based companies

- SaaS platforms

- Biotech and health innovation firms

If 80% or more of the company’s assets are used to run an active, qualified business, you’re in good shape to meet QSBS requirements.

5. You Must Hold the Stock for at Least 5 Years

To qualify for the full 100% capital gains exclusion, you must hold your QSBS stock for more than five years.

However, under the QSBS 2026 updates:

- 3 years = 50% exclusion

- 4 years = 75% exclusion

- 5+ years = 100% exclusion (up to $15M per issuer)

Your holding period starts on the stock issuance date—not when a SAFE converts or an option is granted. This distinction matters, especially around liquidity events or early exits.

Bonus Tip: Don’t Forget the Paper Trail

QSBS eligibility is great—but you have to prove it.

Auditors and the IRS may require:

- Cap tables showing original issuance

- 83(b) election filings (if applicable)

- Gross asset confirmation

- Industry classification

- Stock purchase agreements or grant docs

Think You’re Business is QSBS Eligible? Let’s Confirm It

Even one missing element can disqualify your shares. If you’re planning an exit, receiving new grants, or raising a round, now is the time to verify your QSBS status and optimize your strategy.

Let’s make sure you’re set up for a tax-free win.

Let’s talk

Schedule an intro call to learn about why MeldVal is important for your business. Or have any questions? We’re here to help.

Contact us