For private equity fund accounting, fair value reporting isn’t just about compliance—it’s a core driver of audit efficiency, investor confidence, and fund performance visibility. ASC 820 requires rigorous documentation, current valuation memos, and traceable assumptions.

Done poorly, it creates friction. Done well, it becomes a competitive advantage.

7 Best Fair Value Reporting Practices for Private Equity Fund Accounting

Here’s how leading private equity fund accounting teams structure their fair value reporting process to meet ASC 820 expectations—and pass audits with minimal drama.

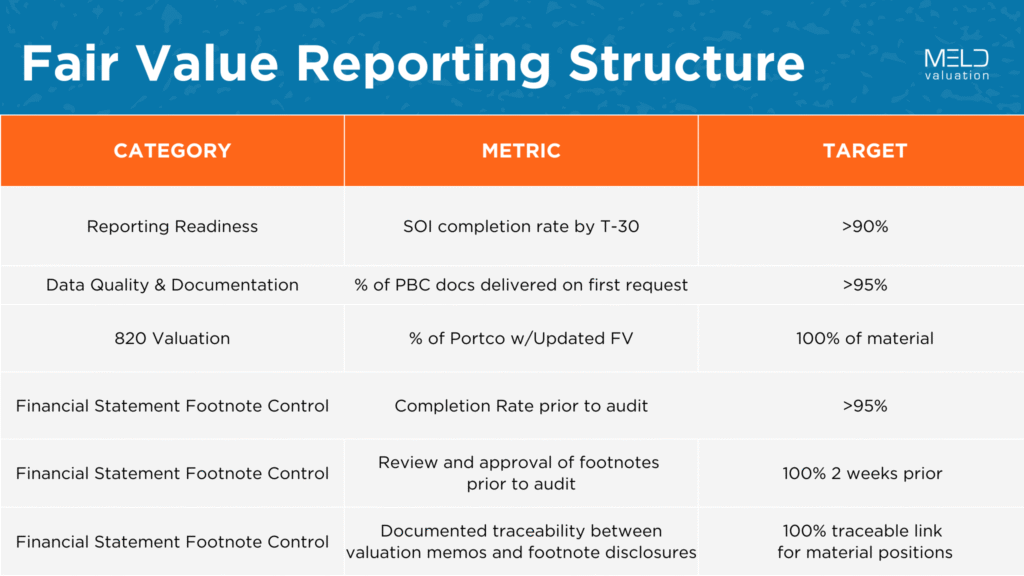

1. Finalize the Schedule of Investments Early

Why It Matters: The Schedule of Investments (SOI) is the foundation of your fair value review. If it’s not accurate and reconciled well ahead of audit kickoff, valuation and footnote prep will stall.

Best Practice: Target 90%+ completion of the SOI at least 30 days before your audit begins. This allows your valuation team to prioritize memo updates, ensures alignment with the fund administrator, and reduces back-and-forth with your audit team.

2. Deliver a Fully Documented PBC Package

Why It Matters: Audit delays often stem from missing documents—term sheets, cap tables, board approvals, or incomplete valuation workpapers.

Best Practice: Set a target of delivering 95%+ of PBC (Prepared by Client) documentation on the first auditor request. Ensure all relevant docs are flagged and accessible in one system. This streamlines your audit testing and speeds up the valuation review process.

3. Prepare Updated ASC 820-Compliant Valuation Memos

Why It Matters: ASC 820 requires supportable, market-calibrated fair value estimates. Auditors expect clear documentation of methodology, inputs, and rationale—especially for Level 3 assets.

Best Practice: Ensure 100% of material investments (positions over 5% of NAV) have updated fair value memos before the audit begins.

Your valuation memo should:

- Justify the method used (e.g., OPM, scenario-based, backsolve)

- Calibrate to recent transactions

- Define risk-adjusted discount rates

- Align with footnote disclosures

4. Model Complex Instruments Separately

Why It Matters: SAFEs, convertible notes, and preferred equity with structured features can’t be treated like common equity. If your private equity fund accounting team ignores this, it can materially misstate NAV.

Best Practice: Use modeling techniques suited to each security:

- Lattice models for convertible notes or multi-path outcomes

- Scenario-based models when future rounds or exits are uncertain

- OPMs for multi-class equity structures

Segregate these from common equity positions and document assumptions explicitly.

5. Control Your Financial Statement Footnotes

Why It Matters: Footnotes are the bridge between your valuation work and your fair value reporting financial statements. If they’re vague, inconsistent, or incomplete, expect questions—and potential delays.

Best Practices:

- Complete 95% of footnote drafting at least two weeks prior to audit fieldwork

- Ensure 100% traceability between memos and footnotes for material positions

- Use a standard checklist to cover hierarchy levels, methodology explanations, and related party disclosures

Forward-thinking firms are even using AI tools to scan footnotes for consistency and auto-generate first drafts based on valuation memos.

6. Document Internal Review and Sign-Off

Why It Matters: Auditors want to see that someone on your team, not just your valuation provider, reviewed and approved the memo logic and assumptions.

Best Practice: Maintain an internal sign-off log that documents who reviewed each memo, when it was reviewed, and what updates were made prior to submission. This adds credibility and signals strong internal controls.

7. Make It a Repeatable System

The best funds don’t just aim to survive audit season, they build a repeatable, scalable fair value reporting process.

That means:

- Automated data intake and reconciliation

- Centralized document storage

- Standardized memo templates

- Periodic mid-year valuation reviews

Need Help Getting Audit-Ready?

Meld Valuation delivers ASC 820-compliant, audit-defensible valuation reports trusted by leading fund managers, CFOs, and controllers. Whether you’re reviewing 10 positions or 100, we help you stay ahead of the audit curve.

Let’s talk

Schedule an intro call to learn about why MeldVal is important for your business. Or have any questions? We’re here to help.

Contact us