Compliance, Fundraising

Hiring A Business Valuation Firm: Experience And Why It's Important

By Dan Eyman

November 02, 2018

When it comes times to hire a firm, invest wisely. More often than not, different companies offer varying values for any business. And depending on the experience of the firm they could be widely different.

There are money approaches to valuing a business and many things to consider when deciding on which approaches to implement. Whichever methods one uses, accuracy and rigor is demanded, which can only be garnered through experience.

What Experience Brings

Tested internal business systems

Every business starts with teething problems. It may be that it does not have support staff, or it lacks the needed mode of operation. Whichever the case, such issues affect how the firm delivers on its mandate. Considering that the process of valuation is multi-dimensional, having a team that knows how to coordinate functions seamlessly is imperative. This is what experienced firms bring.

They have sorted out their operational issues to a point where they can deliver on what they promise. They know who does what and when. They know where to get things and at what cost. They have established systems that can support any temporary engagement. Unlike start-ups that have not instituted a tradition, experienced firms have an organizational culture that guides them in their operations.

The right tools

Each step of knowing what the business is worth requires several tools. Some of these tools include data collection, financial analysis, legal, accounting, and report-writing tools. Experience brings a history of things, knowledge, tools and other relevant requirements to the process.

A credible firm in the industry has access to databases that can help ease the process (CapitalIQ). For example, the market approach requires that you use data on existing businesses. This is not possible if you don’t have such information. Furthermore, you want a company that has tested and proven models (link to eshares post with text “or you can end up with this”) that have been built to handle even the most complex situations. A lot of firms now and in the past have tried to keep costs low by not purchasing tools. The result is a poor report that lacks credibility and rigor and those of us in the industry know who these firms are.

Ability to translate the Qualitative into the Quantitative

You don’t want a valuation firm that will just give you a report; you want a firm that understands the needs of the valuation and goes ahead to tailor-make your statement with your needs in mind. Anybody can just crank through the formulas and numbers. That are several firms out there that have tried to “automate” the process of valuation of claim to have sophisticated software that can produce a report. I can tell you first hand this is not true, and I know because I have peeked behind the curtain so to speak, one firm even asked me to give them my opinion of their software. Trust me they did not want my honest opinion. I digress. Back to my point experience matters because valuation is ultimately a qualitative exercise that requires judgement (anyone who says its part art part science has not thought that through. I used to be a scientist, you can download my last published peer reviewed article if you wish. Valuation is definitely not science and art is way more enriching.

The only way to develop a sense of this judgement is through experience and that applies to a lot of professions, most or all I would argue. Ask yourself this, who would you want performing a major surgery on you, the doctor who just got out of Medical school or the surgeon with 20 years of experience. I’ll take the latter. Further, less experienced software companies offering valuation services, which is a problem unto itself, often do not even know what questions to ask.

We have done many valuations here at Meld Valuation for clients of these companies, even though the valuation service is paid for by the client with the software company. I.e. choosing the software company costs them twice. They pay them once and then end up paying us as well. The situation is usually one in which the client has raised a round and or needs a new valuation but there are extenuating circumstances that need to be considered. Extenuating circumstances do not work well in a “just run the cap table through the software and let the computer do the math” situation. Experience in knowing how to handle them does though.

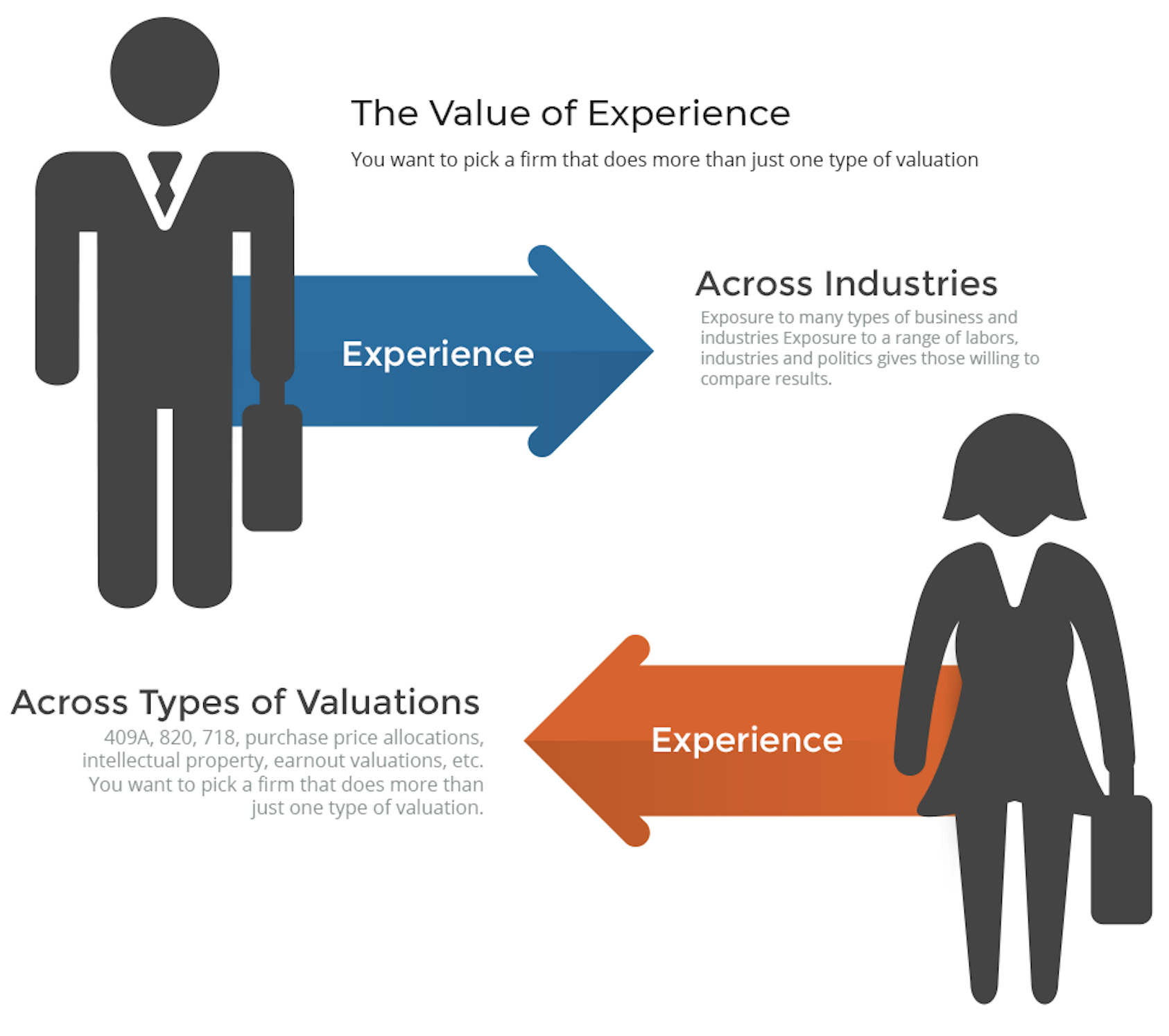

Experience Across Industries

No one wants a one trick pony for their birthday party right? One of the things we underestimate the most is how different worldviews and perspective are from each other and from industry to industry. Exposure to a range of labors, industries and politics gives those willing to compare results, a big picture of directions we are moving toward. Exposure to many types of businesses and industries also brings a fresh perspective to valuation work. Narrow experience leads to myopic thinking and perspectives. Firms that offer you software and “add on” valuation services will not have this exposure and will be less likely to view perspectives from your point of view and make sure that is reflected in the valuation.

Experience Across Types of Valuations

409A, 820, 718, purchase price allocations, intellectual property, earnout valuations, etc….I’m not knocking specialization and I’m not saying a firm needs be everything to everyone, jack of all trades and all, but you want to pick a firm that does more than just one type of valuation.

Exposure to different approaches and different standards will ultimately shape a firm and its ability handle special or even ordinary situations that come up. It speaks to the rigor of the firm. The trick is to specialize to the right point, which requires judgement, the same judgement that is shaping your valuation report.

I’m not knocking specialization and I’m not saying a firm needs be everything to everyone, jack of all trades and all, but you want to pick a firm that does more than just one type of valuation.

Conclusion

As we have reviewed, experience comes with the tools, teams, respect, systems, among many other things. Combined, these things make a valuation worth your investment. However, do not be duped into thinking that software providers are valuation firms as well or that it is easy to automate. If you choose to go the “cheap route” then your employees often suffer.

The very people you raised money to pay for and are helping build your company loose out. Business owners want to align the incentives with the option holder with valuation creation so there is the most upside to the options. Often what we see with companies that go with less than optimal valuation services are strike prices that are too high or while acceptable could be lower if they had more experience and knew how to pull certain levers so to speak.

I’ll conclude with a short story that encapsulates my points:

An old boilermaker was hired to fix the steam engine of a giant ship. After arriving and listening to the engineer’s description of the problem, he asked a few questions and then checked the boiler room. Carefully inspecting the maze of twisting pipes, feeling the pipes with his hand. He then reached into his tool bag and grabbed a small hammer and tapped once on a valve. As he did so the boiler system lurched into perfect action. A week later the steamship owner received a bill for $1,000. The ship owner complained because from the perspective of the owner the boilermaker barely did anything to fix the problem. When the owner asked for an itemized bill, this is what her received:

Tapping with a hammer: $0.50

Knowing where to tap: $999.50

Total: $1,000

Choosing a firm or questions to ask a firm.

Let’s talk

Schedule an intro call to learn about why MeldVal is important for your business. Or have any questions? We’re here to help.

Contact us